SeaBank Philippines is proud to offer high-interest savings accounts that provide individuals with a competitive rate of 4.5% for the first ₱250,000 in deposits. This adjustment will take effect from July 13, 2023. With SeaBank, you can grow your savings faster and reach your financial goals sooner.

As a leading financial institution in the Philippines, SeaBank is committed to helping its customers maximize the growth potential of their savings. By offering attractive interest rates, SeaBank ensures that your money works harder for you, allowing you to enjoy the benefits of high-yielding savings accounts.

But that’s not all. SeaBank goes beyond just competitive interest rates. We provide a range of benefits to our customers, including convenient mobile banking services, free transfers to other banks and e-wallets, round-the-clock customer service, and discounts on mobile load transactions. With SeaBank, banking is made easy, secure, and rewarding.

Key Takeaways:

- SeaBank Philippines offers high-interest savings accounts with a competitive rate of 4.5% for the first ₱250,000 in deposits.

- Effective from July 13, 2023, this adjustment ensures that your savings can grow faster.

- SeaBank provides additional perks such as mobile banking services, free transfers, round-the-clock customer service, and discounts on mobile load transactions.

- High-interest savings accounts are a popular choice among savers in the Philippines for their potential to earn higher returns.

- SeaBank is committed to providing innovative financial solutions to cater to the evolving needs of its customers.

ABOUT SEABANK

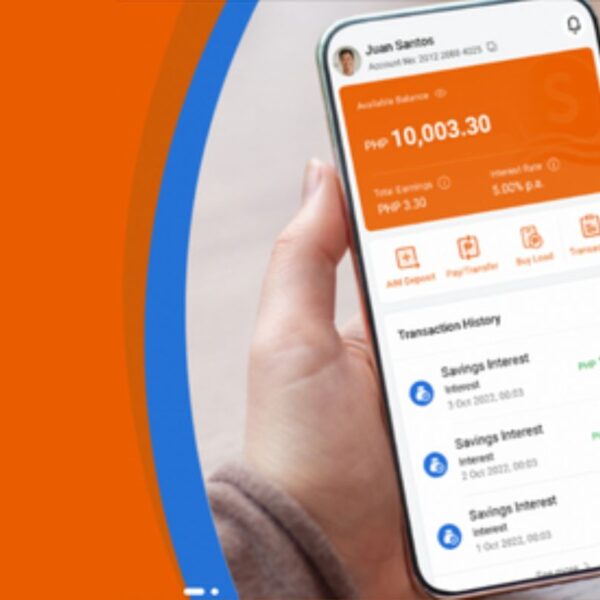

SeaBank is a digital bank owned by Sea Money, a subsidiary of Sea Group, which is also the parent company of Shopee. The bank is approved by the Bangko Sentral ng Pilipinas (BSP), PDIC-insured, and registered with the Securities and Exchange Commission (SEC). One of the most notable features of Sea Bank is its high interest rate of 5% annually, credited daily, compared to traditional banks that only offer 0.0625% annually credited quarterly.

PROS AND CONS OF USING SEABANK

PROS

- High-interest rates (4.55% annually, credited daily)

- No minimum balance

- No transfer fees

- Easy and fast account opening process

CONS

- No bill payments or investment options

- No ATM card

HOW TO OPEN AN ACCOUNT IN SEABANK

- Download the Sea Bank app from the Apple App Store, Google Play Store, or Huawei App Gallery.

- Sign up using a mobile number, Apple, or Shoppee.

- Undergo facial verification.

- Upload your ID and complete personal details.

- After completing these steps, wait for a confirmation or notification that you have been fully registered.

Competitive Interest Rates for Deposits

When it comes to saving money, finding a bank that offers competitive interest rates is essential. With SeaBank Philippines, you can enjoy high-yielding savings accounts that help your deposits grow. SeaBank is proud to provide a competitive interest rate of 4.5% for the first ₱250,000 in deposits. This rate represents a 0.5% decrease from its previous rates, making SeaBank even more attractive to savers.

But the benefits don’t stop there. If you have additional balances beyond the initial ₱250,000, don’t worry. SeaBank still offers an interest rate of 3% on those amounts. This means that no matter how much you save, you can still earn competitive interest on your deposits.

Why Choose SeaBank for Your Savings?

- Competitive Rates: SeaBank’s interest rates are designed to attract customers looking for high-yielding savings accounts. By offering competitive rates, SeaBank helps you make the most out of your hard-earned money.

- Flexibility: With SeaBank, you have the flexibility to deposit any amount you desire. Whether it’s ₱250,000 or more, you can take advantage of the competitive interest rates and watch your savings grow steadily over time.

- Reliable Service: SeaBank is committed to providing reliable and secure banking services. You can trust that your deposits are in safe hands, allowing you to save with peace of mind.

So why settle for average interest rates when you can enjoy competitive rates with SeaBank Philippines? Start maximizing the growth potential of your savings today.

Stay tuned for the next section, where we will explore the various benefits that SeaBank Philippines offers to its customers.

Benefits of SeaBank Philippines

SeaBank Philippines offers a range of benefits to its customers, ensuring a seamless and rewarding banking experience. Here are some key advantages of banking with SeaBank:

- Safe and Secure Mobile Banking Services: SeaBank provides customers with safe and secure mobile banking services, allowing them to conveniently manage their accounts at any time and from anywhere. With robust security measures in place, customers can have peace of mind knowing that their financial information is protected.

- Free Transfers to Other Banks and E-Wallets: SeaBank customers can enjoy free transfers to other banks and e-wallets, making it easier and more convenient to conduct financial transactions. This feature saves customers time and money, eliminating the need for additional transfer fees.

- Round-the-Clock Live Customer Service: SeaBank understands the importance of prompt and efficient customer service. That’s why the bank offers round-the-clock live customer support, ensuring that customers’ concerns are addressed promptly. Whether it’s a question, issue, or feedback, customers can rely on SeaBank’s dedicated support team.

- Discounts on Mobile Load Transactions: As an added value, SeaBank provides its customers with discounts on mobile load transactions. This perk allows customers to save on their mobile expenses while benefiting from the convenience of banking with SeaBank.

By offering these benefits, SeaBank Philippines aims to enhance the overall banking experience for its customers and provide them with valuable incentives for choosing SeaBank as their preferred banking partner.

SeaBank Philippines: Providing Innovative Financial Solutions

SeaBank Philippines is dedicated to delivering innovative financial solutions to its customers. As a subsidiary of Sea Limited, a Singapore-based global consumer internet company, SeaBank has the advantage of leveraging its expertise to provide cutting-edge banking solutions.

With a focus on digital payments and financial services, SeaBank Philippines aims to meet the evolving needs of customers in the modern banking landscape. By harnessing the power of technology and innovation, SeaBank offers a range of products and services designed to make banking more convenient, secure, and accessible.

One of SeaBank’s standout features is its state-of-the-art mobile banking app, which allows customers to manage their accounts and perform transactions on the go. With just a few taps on their smartphones, customers can check their balances, transfer funds, pay bills, and even apply for loans or credit cards.

In addition to its mobile app, SeaBank Philippines provides digital payment solutions that enable customers to make seamless and secure transactions. Whether it’s shopping online, paying for utilities, or transferring money to friends and family, SeaBank offers a wide range of options to meet every customer’s needs.

Furthermore, SeaBank understands the importance of financial literacy and aims to empower its customers with knowledge and resources. Through educational materials, online tutorials, and informative blog posts, SeaBank helps customers make informed financial decisions and achieve their financial goals.

Benefits of SeaBank’s Innovative Financial Solutions

- Simplified banking processes: SeaBank’s digital solutions streamline banking transactions, reducing the need for customers to visit physical branches.

- Enhanced security: With advanced security measures in place, SeaBank ensures the safety of customer data and transactions.

- Convenient access: SeaBank’s mobile app allows customers to manage their finances anytime, anywhere, providing unparalleled convenience.

- Competitive rates: SeaBank offers attractive interest rates and rewards programs, allowing customers to maximize their savings and earn more.

| Features | Benefits |

|---|---|

| State-of-the-art mobile banking app | Convenient account management, seamless transactions |

| Digital payment solutions | Secure and easy online transactions, flexibility in payment methods |

| Financial literacy resources | Empowers customers to make informed financial decisions, achieve financial goals |

About SeaBank Philippines

SeaBank Philippines is a mobile banking app and a subsidiary of Sea Limited, a global consumer internet company based in Singapore. Sea Limited operates various businesses, including digital entertainment, e-commerce (Shopee), and digital payments/financial services (SeaMoney). SeaBank Philippines leverages the extensive experience of Sea Limited to provide secure and reliable banking services to its customers.

Key Features of SeaBank Philippines:

- Convenient mobile banking app

- Backed by Sea Limited, a reputable global company

- Wide range of banking services available

- Secure and reliable platform

- Easy access to accounts and transactions

- Integration with other Sea Limited services

With SeaBank Philippines, customers can enjoy the convenience of managing their finances on the go through the intuitive mobile banking app. As a subsidiary of Sea Limited, SeaBank combines technological innovation with financial expertise to offer a seamless banking experience. Customers can trust SeaBank for their banking needs, knowing that their accounts and transactions are protected by state-of-the-art security measures.

Moreover, SeaBank Philippines is committed to continuously enhancing its services and expanding its offerings to meet the evolving needs of customers. By leveraging the resources and capabilities of Sea Limited, SeaBank ensures that customers have access to innovative financial solutions that align with the demands of the modern banking landscape.

| SeaBank Philippines | Sea Limited |

|---|---|

| Mobile Banking App | Global Consumer Internet Company |

| Secure and Reliable | Diversified Business Portfolio |

| Convenient Access to Accounts | Innovative Financial Solutions |

SeaBank Philippines Interest Rate Drop

SeaBank Philippines recently announced a significant drop in its interest rates, providing more attractive options for savers. The new interest rate of 4.5% applies to the first ₱250,000 in deposits, aiming to align with market conditions and offer competitive rates to customers.

This move by SeaBank demonstrates its commitment to providing customers with the best possible savings opportunities. By reducing the interest rate, SeaBank aims to attract new customers while also rewarding existing ones. This adjustment is a testament to SeaBank’s dedication to staying competitive in the ever-evolving financial landscape.

The new interest rate of 4.5% will take effect starting from July 13, 2023, allowing customers to take advantage of this attractive rate on their deposits. This adjustment is a positive development for savers looking to grow their wealth while benefiting from the security and reliability offered by SeaBank Philippines.

| Interest Rate | Deposits |

|---|---|

| 4.5% | First ₱250,000 |

SeaBank’s interest rate drop is a promising opportunity for individuals seeking high-interest savings with a trusted banking institution. With this adjustment, SeaBank Philippines continues to solidify its position as a leading player in the banking sector.

Stay tuned for the next section, where we will explore SeaBank Philippines’ exceptional customer support and its commitment to serving its clients’ needs.

SeaBank Philippines Customer Support

SeaBank Philippines understands the importance of providing exceptional customer support to ensure a seamless banking experience for its customers. With a commitment to prompt and efficient service, SeaBank prioritizes addressing customer concerns promptly and effectively.

One of the key features of SeaBank Philippines is its round-the-clock live customer service, allowing customers to reach out for assistance at any time. Whether it’s a query about account transactions, technical support, or general inquiries, the dedicated customer support team is available around the clock to assist customers with their banking needs.

SeaBank Philippines values its customers and aims to provide personalized support to address their specific requirements. As a result, customers can expect responsive and reliable assistance tailored to their individual needs.

Benefits of SeaBank Philippines’ Customer Support:

- 24/7 Accessibility: Customers can reach out for assistance at any time, ensuring support is available whenever they need it.

- Prompt Response: SeaBank’s customer support team strives to address customer concerns promptly and efficiently, minimizing any inconvenience that customers may face.

- Personalized Service: SeaBank Philippines understands that every customer is unique, and therefore provides personalized support to cater to individual needs and requirements.

- Expert Assistance: The customer support team comprises knowledgeable professionals who can provide expert guidance and assistance for a wide range of banking queries and concerns.

Get PHP 50.00 now by signing up with SeaBank using my referral code: ML699730

Experience Seamless Banking with SeaBank

SeaBank Philippines is committed to delivering excellence in customer support, ensuring that customers can enjoy a seamless and hassle-free banking experience. With responsive and reliable assistance available round the clock, SeaBank provides the support customers need to ensure their banking needs are met.

Now that you know about the exceptional customer support offered by SeaBank Philippines, you can confidently choose this banking option and experience the convenience and peace of mind it provides.

For more information about SeaBank and its services, feel free to reach out to the customer support team at any time.

SeaBank Philippines Promotions and Discounts

SeaBank Philippines is committed to providing value to its customers through various promotions and discounts. The bank understands the importance of saving money and aims to make banking more affordable and convenient for its valued clients.

One of the perks of banking with SeaBank is the availability of discounts on mobile load transactions. By using the SeaBank mobile banking app, customers can save on their mobile expenses while enjoying the benefits of seamless banking at their fingertips.

SeaBank Philippines may also introduce additional promotions and discounts from time to time, allowing customers to further maximize their savings and gain more value from their banking experience.

Stay updated with SeaBank’s latest promotions and discounts by visiting their official website or following their social media accounts.

High-Interest Savings in the Philippines

High-interest savings accounts are a popular choice among savers in the Philippines. With the competitive interest rates offered by banks like SeaBank Philippines, individuals can maximize the growth potential of their savings. These accounts provide an opportunity to earn higher returns compared to traditional savings accounts, making them an attractive option for those looking to grow their wealth.

| Banks | Interest Rate | Minimum Deposit |

|---|---|---|

| SeaBank Philippines | 4.5% | ₱250,000 |

| Bank of the Philippines Islands (BPI) | 3.5% | ₱10,000 |

| Philippine National Bank (PNB) | 3.25% | ₱5,000 |

| Metrobank | 3% | ₱2,000 |

If you’re considering opening a high-interest savings account, it’s important to compare the different offers available from various banks. The table above shows a comparison of interest rates and minimum deposit requirements for some of the top banks in the Philippines. Keep in mind that interest rates are subject to change and may vary depending on the bank’s policies and market conditions.https://www.youtube.com/embed/SoFt-RRI9I8

Conclusion

Seabank Philippines offers high-interest savings accounts with competitive rates, providing individuals in the Philippines with an excellent opportunity to maximize the growth potential of their savings. With its innovative financial solutions, round-the-clock customer support, and a range of perks, Seabank is dedicated to meeting the evolving needs of modern savers.

By leveraging its affiliation with Sea Limited, a Singapore-based global consumer internet company, Seabank Philippines stands out in the market as a reliable and secure mobile banking app. Customers can enjoy the convenience of managing their accounts anytime and anywhere through the Seabank mobile banking app, ensuring a seamless banking experience.

With its commitment to delivering high-interest savings and exceptional customer service, Seabank Philippines is the go-to choice for individuals looking to grow their wealth. Open a Seabank account today and take advantage of competitive rates, secure mobile banking, and a range of benefits to achieve your financial goals.

FAQ

What is the interest rate offered by SeaBank Philippines?

SeaBank Philippines offers a competitive interest rate of 4.5% for the first ₱250,000 in deposits.

What is the interest rate for balances beyond ₱250,000?

Balances beyond ₱250,000 will accrue interest at a rate of 3%.

What are the benefits of banking with SeaBank Philippines?

SeaBank Philippines provides various perks including mobile banking services, free transfers to other banks and e-wallets, round-the-clock customer service, and discounts on mobile load transactions.

How does SeaBank Philippines ensure customer support?

SeaBank Philippines offers round-the-clock live customer service to address customer concerns promptly and efficiently.

Does SeaBank Philippines offer any promotions or discounts?

Yes, SeaBank Philippines provides discounts on mobile load transactions and may introduce additional promotions and discounts from time to time.

What are the advantages of high-interest savings accounts?

High-interest savings accounts allow individuals to maximize the growth potential of their savings and earn higher returns compared to traditional savings accounts.

How does SeaBank Philippines provide innovative financial solutions?

As a subsidiary of Sea Limited, SeaBank Philippines leverages its affiliation to deliver cutting-edge banking solutions to its customers, focusing on digital payments and financial services.

What is SeaBank Philippines’ affiliation with Sea Limited?

SeaBank Philippines is a mobile banking app and a subsidiary of Sea Limited, a Singapore-based global consumer internet company operating businesses in digital entertainment, e-commerce (Shopee), and digital payments/financial services (SeaMoney).

What is the effective date of the recent interest rate adjustment?

The new interest rate of SeaBank Philippines will be effective from July 13, 2023.

RELATED POSTS

-

Autosweep Guide: Easy Toll Payments Simplified

Welcome to our Autosweep guide, where we simplify toll payments in the Philippines with the Autosweep RFID system. Say goodbye to long queues and the hassle of physical cash payments. With Autosweep RFID, traveling becomes seamless and time-efficient. In this guide, we will explore how the Autosweep RFID works and how you can get it

-

30 Innovative Business Ideas to Start in the Philippines in 2024

Do you want to start your own business in the Philippines but want to stand out from the crowd? Our list of 30 unique and profitable niche business ideas for 2024 might be just what you need. Explore emerging opportunities in niche markets ranging from sustainable and environmental products to cutting-edge services. Motivate yourself and

-

Top Spots to Buy a House in Laguna | Real Estate Guide

Welcome to our comprehensive real estate guide, where we will explore the top spots to buy a house in Laguna. Choosing the perfect location is crucial when it comes to purchasing a new home, and Laguna offers a variety of attractive options for potential buyers. From its natural beauty to its thriving property market, Laguna

-

Best Cavite Real Estate: Top Spots to Buy a House

Welcome to Cavite, a province in the Philippines that offers a myriad of opportunities for homebuyers. With its strategic location close to Metro Manila, economic prosperity, and affordability, Cavite has become a favored destination for those looking to settle down and invest in real estate. In this article, we will unveil the charm of Cavite

-

Best Cavite Real Estate: Top Spots to Buy a House

Welcome to Cavite, a province in the Philippines that offers a myriad of opportunities for homebuyers. With its strategic location close to Metro Manila, economic prosperity, and affordability, Cavite has become a favored destination for those looking to settle down and invest in real estate. In this article, we will unveil the charm of Cavite

-

Top Spots to Buy a House in Cebu | Real Estate Guide

Are you looking to buy a house in Cebu? With its vibrant economy, beautiful landscapes, and rich cultural heritage, Cebu has become a popular destination for real estate investment. Whether you’re a local resident or a foreigner looking to settle down in the Philippines, Cebu offers a wide range of options for homebuyers. But with

-

Top Spots to Buy a House in Cebu | Real Estate Guide

Are you looking to buy a house in Cebu? With its vibrant economy, beautiful landscapes, and rich cultural heritage, Cebu has become a popular destination for real estate investment. Whether you’re a local resident or a foreigner looking to settle down in the Philippines, Cebu offers a wide range of options for homebuyers. But with

-

Philippines SIM Card Guide for Travelers & Expats

In this guide, we’ll provide you with all the information you need on SIM card options, prices, where to buy them, activation processes, compatibility, and tips for choosing the best SIM card for your needs. Key Takeaways: Understanding Mobile Connectivity in the Philippines In order to navigate the world of mobile connectivity in the Philippines,

-

A Comprehensive Guide to Applying for the DOLE-TUPAD Program

Introduction In a significant move to fortify job creation for Filipinos, the Marcos administration is allocating a substantial PHP12.92 billion for the implementation of the Department of Labor and Employment’s (DOLE) Tulong Panghanapbuhay sa Ating Disadvantaged/Displaced Workers (TUPAD) program in 2024. This funding, as outlined in the 2024 National Expenditure Program (NEP), underscores the government’s

-

Online Selling in the Philippines: The Ultimate Guide

Discover the best items to sell online in the Philippines! From top-sellers to local products and rare finds, this guide has got you covered.

-

SeaBank Review: Top Choice for High-Interest Savings

SeaBank is the best option for those looking for high-interest savings accounts. Find out why customers are flocking to this digital bank.

-

Explore Digital Banks in the Philippines With High Interest Rates

Save more and earn more with the best high-interest online banks in the Philippines. See our top picks now.

-

THE BEST SIM CARD TO BUY IN THE PHILIPPINES

Find the best SIM card in the Philippines that suits your needs and budget. Reliable coverage, fast data speeds, and affordable pricing.

-

IS YOUR SIM DEACTIVATED? Here’s What You Should Do

Have you missed the deadline for SIM registration? Learn what you can do next to avoid losing access to essential services.

-

What Should You Do If Your PH SIM Card Is Lost Or Stolen

Lost or stolen SIM card? Protect your personal information and get a replacement with our guide on what to do if your Philippines SIM card is lost or stolen.

-

The 3 Best Prepaid Medical Insurance in the Philippines

We’ve carefully selected the top three prepaid medical insurance plans for adults in the Philippines based on their affordability and coverage. These plans offer comprehensive protection against accidents, as well as bacterial and viral illnesses that require outpatient care or emergency hospitalization.

-

Quick Guide: How to PASALOAD SMART & TNT

Learn the smart ways to pasaload and share your prepaid credits with your loved ones. This comprehensive guide covers the different methods to pasaload, limitations, and important details to ensure a smooth transaction. Read now and stay connected with Smart!

-

Discover the Best Business to Start in the Philippines this Year

Unlock your potential and unleash your entrepreneurial spirit with these 100 powerful business ideas to start in the Philippines this 2023. From online tutoring to personalized jewelry stores, fuel your passion and ignite your success with these uncommon and emotionally impactful business ventures. Discover your path to financial freedom and build your dream business today.