Over the past few years, digital banking has witnessed remarkable growth in the Philippines. People are increasingly opting for digital banks owing to the convenience of carrying out banking transactions online or via mobile devices. One of the most significant benefits of digital banks is that they offer high interest rates on savings accounts, which is a major advantage over traditional banks. By leveraging advanced technology, digital banks are able to provide seamless and secure banking services, making them an attractive option for Filipinos who value efficiency and flexibility.

Overview of Digital Banking in the Philippines

Brief History and Growth of Digital Banking in the Country

Digital banking has become increasingly popular in the Philippines over the past few years due to the rapid growth of technology and internet usage. In 2017, the Bangko Sentral ng Pilipinas (BSP), or the central bank of the Philippines, introduced regulations that allowed digital banks to operate under its supervision.

These regulations paved the way for digital banks to enter and compete in the local banking industry. Since then, digital banks have been growing steadily and making a significant impact on traditional banking methods.

The introduction of these digital banks has enabled customers to perform almost all their banking services online, including opening accounts, managing transactions, applying for loans, investing money, and more with just a few clicks.

Comparison between Traditional Banks and Digital Banks

Traditional banks still have a strong presence in the Philippine financial sector. However, with fewer physical branches than before due to cost-cutting efforts by traditional banks themselves as well as changing customer behavior where most people prefer self-service channels over traditional ones. Digital banks operate solely online through mobile applications or their websites while traditional banks operate through brick-and-mortar branches that offer face-to-face customer service.

There is also a distinct difference between transaction fees charged by traditional versus digital bank institutions. Traditional institutions charge significantly higher fees compared to their online counterparts than other regions around Southeast Asia.

Additionally, traditional bank processes can be time-consuming with long queues at branches for services like account opening or loan application approvals whereas with digital banking customers can access accounts instantaneously from anywhere at any time without having to leave home or office thereby saving them both time & resources. Overall, both types of bank institutions offer different sets of advantages and disadvantages.

For those who prioritize convenience, accessibility, and low fees, digital banks are the best choice. Meanwhile, traditional banks still provide advantages like personal customer service and a sense of physical security that some customers prefer over Internet banking.

Criteria for Choosing High-Interest Digital Banks

When choosing a high-interest digital bank, there are several criteria that you should consider to ensure that you get the best value for your money. These criteria include interest rates, fees and charges, user experience and interface, security features, and availability of services.

Interest Rates Offered by Different Digital Banks

One of the most important factors to consider when choosing a high-interest digital bank is the interest rate offered. The higher the interest rate, the more money you will earn on your savings. However, it is important to note that not all digital banks offer the same interest rate.

Fees and Charges

Aside from interest rates, another important factor to consider is fees and charges. Some digital banks may charge transaction fees or account maintenance fees that can eat away at your earnings.

It is important to carefully review these fees before opening an account.

User Experience and Interface

The user experience and interface of a digital bank also play a significant role in the overall satisfaction of the customer. A user-friendly interface means that customers can easily navigate through the bank’s services and features without encountering any difficulties or complications.

Security Features

When it comes to finances, security is always paramount. It is important to choose a digital bank that prioritizes the safety and security of its customer’s personal information, account details, and transactions.

Availability of Services

You should consider the availability of services offered by each digital bank. Some banks may offer limited services or restrictions based on location or account type. It is important to know whether or not the services you need are available before opening an account.

Overall these criteria are important to consider when selecting a digital bank. Keep in mind that each individual’s needs may vary, so it is important to carefully review each option and determine which one is best suited for you.

Top High-Interest Digital Banks in the Philippines

1. SEABANK

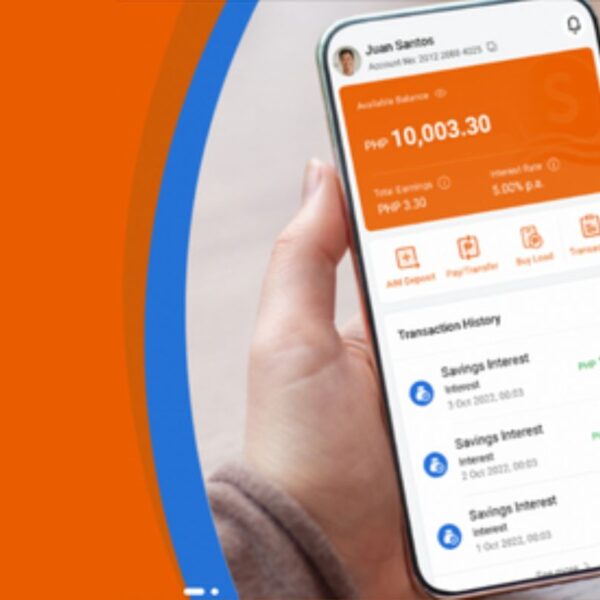

SeaBank, provided by SeaBank Philippines, Inc. (A Rural Bank), is a mobile banking application that allows you to manage your funds on your mobile phone at any time and from any location. You can send and receive transactions from both SeaBank and non-SeaBank customers while earning great interest rates with no additional fees and no minimum balance requirement.

Enjoy daily interest earnings of up to 5% p.a. with no minimum balance requirement. 5% interest p.a. applies to users with account balances up to P250,000. For account balances in excess of P250,000, a 3% annual interest rate will be applied. It is completely free to open an account! You can also transfer funds from ShopeePay to SeaBank for free at any time. The BSP regulates SeaBank Philippines, Inc. (A Rural Bank). The PDIC insures deposits up to P500,000 per depositor.

2. MAYA

Your Savings account gets a daily interest rate of 4.0% per annum and increases the interest rate further based on the spending requirement per tier. Simply pay with Maya to earn up to 6.0% p.a. in bonus interest. Interest rates may fluctuate, but only after the public has been notified. Accounts with no deposits or withdrawals in the previous two years will not earn interest.

Maya Bank, Inc. is regulated by the Bangko Sentral ng Pilipinas (BSP). Deposit accounts are insured by PDIC.

3. CIMB BANK

CIMB Bank is a virtual bank that provides reasonable interest rates on savings accounts, time deposits, and other financial products. It boasts one of the highest interest rates in the business, offering up to 2.5% with FREE Life Insurance coverage of up to PHP 250,000 for merely keeping a PHP 5,000 minimum average daily balance on its UpSave account. There are no fees, no monthly premiums, and no medical exams are required. In addition, CIMB Bank offers free fund transfers and withdrawals from any ATM in the country. Another benefit of CIMB Bank is that it has a low minimum balance requirement, which makes it accessible to anybody.

Deposits are insured by PDIC up to P500,000 per depositor.

Conclusion

In conclusion, due to its convenience and accessibility, digital banking is fast gaining popularity in the Philippines. With the rise of high-interest online banks such as Seabank, CIMB, and Maya, consumers now have additional options for growing their money. Filipinos can choose the finest high-interest digital bank that meets their financial goals and needs by analyzing the features, perks, and fees of each digital bank.

RELATED POSTS

-

Autosweep Guide: Easy Toll Payments Simplified

Welcome to our Autosweep guide, where we simplify toll payments in the Philippines with the Autosweep RFID system. Say goodbye to long queues and the hassle of physical cash payments. With Autosweep RFID, traveling becomes seamless and time-efficient. In this guide, we will explore how the Autosweep RFID works and how you can get it…

-

30 Innovative Business Ideas to Start in the Philippines in 2024

Do you want to start your own business in the Philippines but want to stand out from the crowd? Our list of 30 unique and profitable niche business ideas for 2024 might be just what you need. Explore emerging opportunities in niche markets ranging from sustainable and environmental products to cutting-edge services. Motivate yourself and…

-

Top Spots to Buy a House in Laguna | Real Estate Guide

Welcome to our comprehensive real estate guide, where we will explore the top spots to buy a house in Laguna. Choosing the perfect location is crucial when it comes to purchasing a new home, and Laguna offers a variety of attractive options for potential buyers. From its natural beauty to its thriving property market, Laguna…

-

Best Cavite Real Estate: Top Spots to Buy a House

Welcome to Cavite, a province in the Philippines that offers a myriad of opportunities for homebuyers. With its strategic location close to Metro Manila, economic prosperity, and affordability, Cavite has become a favored destination for those looking to settle down and invest in real estate. In this article, we will unveil the charm of Cavite…

-

Best Cavite Real Estate: Top Spots to Buy a House

Welcome to Cavite, a province in the Philippines that offers a myriad of opportunities for homebuyers. With its strategic location close to Metro Manila, economic prosperity, and affordability, Cavite has become a favored destination for those looking to settle down and invest in real estate. In this article, we will unveil the charm of Cavite…

-

Top Spots to Buy a House in Cebu | Real Estate Guide

Are you looking to buy a house in Cebu? With its vibrant economy, beautiful landscapes, and rich cultural heritage, Cebu has become a popular destination for real estate investment. Whether you’re a local resident or a foreigner looking to settle down in the Philippines, Cebu offers a wide range of options for homebuyers. But with…

-

Top Spots to Buy a House in Cebu | Real Estate Guide

Are you looking to buy a house in Cebu? With its vibrant economy, beautiful landscapes, and rich cultural heritage, Cebu has become a popular destination for real estate investment. Whether you’re a local resident or a foreigner looking to settle down in the Philippines, Cebu offers a wide range of options for homebuyers. But with…

-

Philippines SIM Card Guide for Travelers & Expats

In this guide, we’ll provide you with all the information you need on SIM card options, prices, where to buy them, activation processes, compatibility, and tips for choosing the best SIM card for your needs. Key Takeaways: Understanding Mobile Connectivity in the Philippines In order to navigate the world of mobile connectivity in the Philippines,…

-

A Comprehensive Guide to Applying for the DOLE-TUPAD Program

Introduction In a significant move to fortify job creation for Filipinos, the Marcos administration is allocating a substantial PHP12.92 billion for the implementation of the Department of Labor and Employment’s (DOLE) Tulong Panghanapbuhay sa Ating Disadvantaged/Displaced Workers (TUPAD) program in 2024. This funding, as outlined in the 2024 National Expenditure Program (NEP), underscores the government’s…

-

Online Selling in the Philippines: The Ultimate Guide

Discover the best items to sell online in the Philippines! From top-sellers to local products and rare finds, this guide has got you covered.

-

SeaBank Review: Top Choice for High-Interest Savings

SeaBank is the best option for those looking for high-interest savings accounts. Find out why customers are flocking to this digital bank.

-

Explore Digital Banks in the Philippines With High Interest Rates

Save more and earn more with the best high-interest online banks in the Philippines. See our top picks now.

-

THE BEST SIM CARD TO BUY IN THE PHILIPPINES

Find the best SIM card in the Philippines that suits your needs and budget. Reliable coverage, fast data speeds, and affordable pricing.

-

IS YOUR SIM DEACTIVATED? Here’s What You Should Do

Have you missed the deadline for SIM registration? Learn what you can do next to avoid losing access to essential services.

-

What Should You Do If Your PH SIM Card Is Lost Or Stolen

Lost or stolen SIM card? Protect your personal information and get a replacement with our guide on what to do if your Philippines SIM card is lost or stolen.

-

The 3 Best Prepaid Medical Insurance in the Philippines

We’ve carefully selected the top three prepaid medical insurance plans for adults in the Philippines based on their affordability and coverage. These plans offer comprehensive protection against accidents, as well as bacterial and viral illnesses that require outpatient care or emergency hospitalization.

-

Quick Guide: How to PASALOAD SMART & TNT

Learn the smart ways to pasaload and share your prepaid credits with your loved ones. This comprehensive guide covers the different methods to pasaload, limitations, and important details to ensure a smooth transaction. Read now and stay connected with Smart!

-

Discover the Best Business to Start in the Philippines this Year

Unlock your potential and unleash your entrepreneurial spirit with these 100 powerful business ideas to start in the Philippines this 2023. From online tutoring to personalized jewelry stores, fuel your passion and ignite your success with these uncommon and emotionally impactful business ventures. Discover your path to financial freedom and build your dream business today.