The Importance of Travel Insurance

Traveling to different countries and experiencing new cultures is an exciting adventure that many people look forward to. However, it’s essential to be prepared for any unexpected situations that may arise during your trip. One way of ensuring you are prepared for such situations is by having travel insurance.

Travel insurance offers coverage against possible risks such as getting sick or injured during your trip, losing your luggage or personal belongings, and even trip cancellation or interruption. These risks can make your trip more expensive and stressful if you are not adequately covered.

Why it’s Important to Choose the Right Travel Insurance Company

Choosing the right travel insurance company can make or break your travel experience. Imagine getting into an accident during your trip, only to find out that your travel insurance doesn’t cover medical expenses in a foreign country. This could leave you with hefty medical bills and ruin any future trips you had planned.

It’s crucial to choose a reputable and reliable travel insurance company that provides comprehensive coverage at a reasonable price. With so many options available in the Philippines market, selecting the right one can be overwhelming.

It would help if you considered several factors before making a decision. One important factor is considering whether a particular policy suits your specific needs while keeping in mind potential risks associated with traveling—another critical consideration is customer service levels offered by different companies when it comes down to claiming compensation for losses incurred while on vacation.

Taking out travel insurance is not only important but also essential when traveling abroad. It’s equally crucial to choose the right policy that covers all eventualities without breaking the bank so you can have peace of mind while discovering new places around the world!

Top Travel Insurance Companies in the Philippines

Are you planning a trip to the Philippines? If so, it’s important to choose the right travel insurance company that can provide you with comprehensive coverage during your travels. Here are some of the best travel insurance companies in the Philippines that you should consider for your next trip.

1. AXA Travel Insurance

AXA Philippines is one of the country’s largest and fastest-growing insurance companies, providing financial security to nearly 2 million people through group and individual life insurance, as well as general insurance products.

AXA has over 7,000 financial advisors in over 40 branches and over 900 financial executives in over 900 Metrobank and PSBank branches across the country.

- Enjoy round-the-clock travel and medical assistance anywhere.

- Covers medical expenses such as hospital costs, doctor’s professional fees, and more in case you suffer injury and/or illness during your trip.

- Enjoy the benefit of getting payouts on non-refundable expenses in case of trip cancellation and/or postponement.

- Get protection on your baggage in case of loss or damage.

- Get covered when you suffer death or permanent disablement due to an accident while on a trip.

2. Chubb Travel Insurance

Chubb is the largest publicly traded property and casualty insurer in the world. Chubb, which has operations in 54 countries, offers a wide range of clients commercial and personal property and casualty insurance, personal accident and supplemental health insurance, reinsurance, and life insurance.

The company’s extensive product and service offerings, broad distribution capabilities, exceptional financial strength, underwriting excellence, superior claims handling expertise, and global-local operations set it apart.

- Quality travel insurance at an affordable price

- Access to a global team of travel experts

- Fast, fair, and efficient handling of claims

- 24hours emergency assistance

3. Etiqa Travel Insurance

Etiqa is an international insurance company that operates primarily in Singapore, the Philippines, Indonesia, and Malaysia. It has an extensive network throughout the Philippines. Access a wide range of insurance products and services from anywhere in the country.

- Flight Assistance Benefit for Flight Delay, Trip Cancellation, Missed Connecting Flight, Baggage Delay, Baggage Loss / Damage Airline and other items in the safekeeping of a common carrier, Loss of Travel Documents, Trip Curtailment, and Aircraft Hijack.

- Medical Assistance Benefits such as Hospital Income, Medical and Hospitalization Expenses, Delivery of Medicines, Emergency and Accidental Dental Expenses, Repatriation of Mortal Remains, Arrangement for Funeral Assistance, Medical Evacuation or Repatriation, and Compassionate Visit.

4. Insure Shop by Pioneer

Pioneer’s InsureShop enables you to obtain insurance as soon as you need it. As Pioneer Insurance’s digital arm, InsureShop makes it simple and convenient for you to obtain affordable and dependable travel insurance, motorcycle insurance, and medical cash assistance anytime, anywhere.

- Medical treatment with (New!) COVID-19 coverage, personal accidents, emergency evacuation, and more

- Cash assistance for every 6 hours of delay on your travel

- Baggage delay, damage, and loss

5. Pacific Cross Travel Insurance

Pacific Cross is a market leader in medical, travel, health maintenance organization, and personal accident insurance. Pacific Cross is based in the Philippines and has sister companies in Thailand, Indonesia, and Vietnam.

It is part of a larger group of health insurance companies that operate throughout Asia, with a particular focus on the ASEAN region. The group’s goal is to be known as a market leader and Asian specialist in medical and travel insurance.

- 24/7 Worldwide Emergency Assistance

- Medical Coverage, including for COVID-19

- Cashless Medical Treatment for Hospital Confinement, Out-Patient, and Emergency Room

- Peso, Dollar, and Euro Plans

- Individual, Family, and Group Coverage

- Coverage for persons aged 15 days old to 76 years old and above

- Coverage for Inbound Travels with COVID-19 Coverage

- Coverage for baggage loss, loss of travel documents, flight delay, and much more

6. Malayan Insurance Travel Master

Malayan Insurance Co., founded in 1930, is a leading non-life insurance company in the Philippines. It provides clients and the general public with guaranteed peace of mind through service excellence, quality protection, and the prompt processing and settlement of valid claims.

- Personal Accident

- Emergency Medical Treatment

- Personal Liability

- Recovery of Travel Expenses

- Travel Inconvenience Benefits

- Travel Assistance Benefits

- Cashless Hospitalization

7. Standard Insurance Travel Protect

Standard Insurance is a non-life insurance company that protects you, your family, your assets, your business, and any potential liabilities. For the past 63 years, Standard Insurance has provided insurance protection.

Travel International

- Cashless Settlement

- Wide variety of benefits and coverages

- Up to Php 2.5M cover the medical expenses and personal accident benefits

- Provides coverage for accident-related claims and covered illness/sickness

- Applicable to individuals and groups of travelers

- Duly accredited by Embassies of all Schengen States

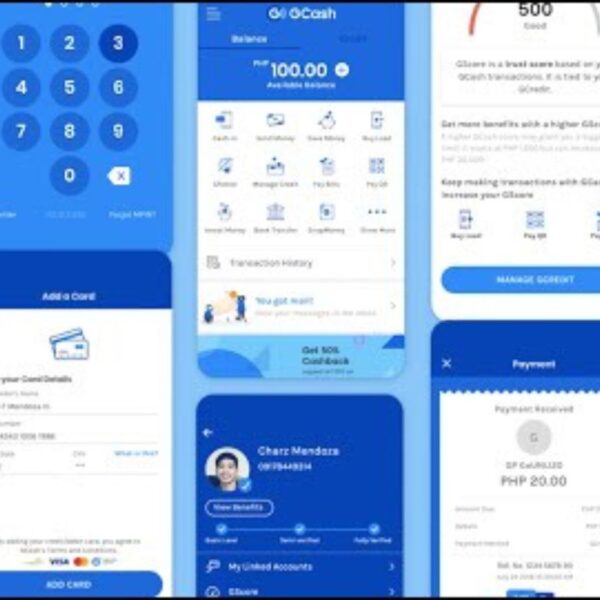

- Pay conveniently using your Credit card, debit card, and Gcash

Travel ASEAN

- Reimbursement type of settlement.

- Up to Php 500,000 limit on medical expense benefit.

- Provides coverage within the Philippines and to ASEAN countries.

- Discounted rates for group travelers.

- Premium payment convenience through credit cards and debit cards.

8. MAPFRE Travel Insurance

MAPFRE Insurance is a non-life insurance company that provides general insurance for financial security and risk management. The company offers fire and allied lines insurance, as well as motor vehicle, personal accident, casualty, liability, engineering, marine cargo, surety, and micro insurance.

MAPFRE Insurance, founded in 1934, is now ranked among the top ten non-life insurance companies in terms of earned premiums, net premiums written, and assets. The company is also among the best capitalized and most solvent in the country’s non-life insurance industry.

International Travel Assist Insurance

- Peso-denominated travel insurance provides protection and coverage for your trips within the Philippines with a maximum period of coverage of 90 days. No extension is allowed. Adults between 60 to 75 years old may be covered subject to a premium surcharge.

Domestic Travel Assist Insurance

- Dollar-denominated travel insurance provides protection and coverage for your trips around the world with a maximum period of coverage of up to 365 days or 1-year coverage. No extension is allowed. Adults between 60 to 75 years old may be covered subject to a premium surcharge with a maximum allowed number of 90 days only for all plans.

Benefits and Coverage Offered by Travel Insurance Companies

Medical Expenses Coverage

One of the most important benefits of travel insurance is medical coverage. This type of coverage will provide you with financial protection in the event that you require medical attention while traveling.

Most travel insurance policies cover medical expenses such as doctor fees, hospitalization charges, and emergency medical treatment. Some policies may also cover pre-existing conditions, so be sure to check with your provider beforehand.

Trip Cancellation and Interruption Coverage

Trip cancellation and interruption coverage is another important benefit offered by many travel insurance companies. This type of coverage will reimburse you for any non-refundable expenses if your trip is cancelled or interrupted due to unforeseen circumstances such as illness, injury, or death in the family. Examples of covered expenses may include flights, hotel reservations, rental cars, and tour fees.

Emergency Medical Evacuation Coverage

Emergency medical evacuation coverage is particularly important if you plan on traveling to remote locations or participating in adventure sports. This type of coverage will provide financial protection for emergency transportation services should you require it. For example, if you are injured while hiking in a remote area and need to be airlifted to a hospital for treatment, your policy may cover these costs.

Baggage Loss or Delay Coverage

Losing your baggage or experiencing delays can be a frustrating experience when traveling. Fortunately, many travel insurance policies offer baggage loss or delay coverage to help ease the burden. This type of coverage typically reimburses you for any lost items or covers expenses associated with delayed bags such as purchasing new clothes or toiletries.

Coverage Limits

It’s important to note that there may be limits on the amount of coverage provided for each benefit listed above. For example, your policy may only cover up to a certain amount for medical expenses or baggage loss. It’s important to read the policy carefully and understand the limits of your coverage before purchasing.

Travel insurance can be a lifesaver when unexpected incidents occur while traveling. The benefits and coverage offered by travel insurance companies can vary widely, so it’s important to choose a policy that fits your needs and budget.

Be sure to research your options thoroughly and read reviews from previous customers before making a decision. With the right travel insurance policy in hand, you can embark on your travels with peace of mind knowing that you are protected.

Factors to Consider When Choosing a Travel Insurance Company

Choosing the right travel insurance company can be overwhelming, especially if you’re not familiar with the different factors that you need to consider. Here are some of the most important things to keep in mind when choosing a travel insurance company in the Philippines.

Price

The price of a travel insurance policy is one of the most important factors that people consider when choosing a provider. While it’s tempting to only look at the cheapest options available, it’s important to remember that cheaper isn’t always better. It’s crucial to make sure that your policy provides enough coverage for your needs and budget.

You can compare prices from different providers by using an online comparison tool. Keep in mind that some providers offer discounts or promotions, so it’s worth taking the time to research and compare.

Coverage Limits

The amount of coverage provided by your policy is another essential factor when choosing a travel insurance company. Look for policies that provide adequate coverage limits for medical expenses, trip cancellations, emergency medical evacuations, and baggage loss or delay.

It’s also important to read through the fine print and understand what specific situations are covered under your policy. Some policies may exclude certain activities such as extreme sports or pre-existing conditions, while others may have higher deductibles or co-pays.

Customer Service

The level of customer service provided by your travel insurance company can make all the difference when you’re dealing with an emergency situation abroad. Look for companies that have 24/7 customer support and offer assistance in multiple languages. You can also read reviews from previous customers online to get an idea of how responsive a provider is when it comes to claims processing or addressing customer concerns.

Another important factor to consider is whether the company has a local representative in the Philippines who can assist you in case of an emergency. This can be especially helpful if you’re not familiar with the local healthcare system or need help navigating a difficult situation.

The Bottom Line

When choosing a travel insurance company, it’s important to consider more than just the price. Look for policies that provide adequate coverage for your needs, have good customer service, and offer peace of mind while you’re traveling.

Remember to read through the fine print and understand exactly what your policy covers and excludes. By doing your research and comparing different providers, you’ll be able to choose one that fits your needs and budget.

Tips for Buying Travel Insurance in the Philippines

Research Thoroughly Before Purchasing

When it comes to purchasing travel insurance, you want to make sure that you’re getting the best policy for your needs. Take some time to research different companies and their policies before making a final decision.

Look at their coverage options, prices, and customer reviews. Make sure you understand what is covered under each policy.

Some policies may have exclusions or limitations on certain types of activities or destinations. It’s important to know what is and isn’t covered so that you can choose the right policy for your trip.

Read Reviews from Previous Customers

One of the best ways to get an idea of how good a travel insurance company is is by reading reviews from previous customers. Search online for reviews on different travel insurance companies and read through them carefully.

Look for reviews from customers who have had similar experiences or trips to yours. If someone had a positive experience with a particular company, it’s usually a good sign that they will provide good service for your trip as well.

Choose a Policy that Fits Your Needs and Budget

When choosing a travel insurance policy in the Philippines, it’s important to find one that fits both your needs and budget. Consider factors such as trip duration, destination, activities planned, and any pre-existing medical conditions.

Make sure you’re not paying for coverage you don’t need or won’t use. It’s also important to consider the deductible amount – this is the amount you’ll have to pay out-of-pocket before your insurance kicks in.

Remember that cheaper isn’t always better when it comes to travel insurance. Make sure you’re getting adequate coverage at a price point that works for you.

Additional Tips:

– Look into any existing insurance coverage you may already have (such as through your credit card or employer) to see what’s already covered.

– Consider purchasing travel insurance as soon as you book your trip to ensure maximum coverage.

– Don’t be afraid to ask questions or clarify any concerns before purchasing a policy.

Conclusion

In conclusion, purchasing travel insurance is an essential part of planning any trip. The best travel insurance companies in the Philippines listed above offer comprehensive coverage and benefits that can protect you against unexpected events and give you peace of mind while traveling. As travel continues to evolve, it’s vital to stay protected and informed about the latest travel policies and regulations. We hope that this list of the best travel insurance companies in the Philippines will help you make an informed decision and provide you with the protection you need to enjoy your travels to the fullest. Remember, by investing in travel insurance, you’re not only protecting yourself but also your loved ones and your investment in your travel experience.

RELATED POSTS

-

Activate Your Smart SIM Quickly – Easy Guide

Are you ready to activate your Smart SIM and start enjoying all the benefits of Smart’s network? Whether you’re a new subscriber or switching from another provider, activating your Smart…

-

Philippines SIM Card Guide for Travelers & Expats

In this guide, we’ll provide you with all the information you need on SIM card options, prices, where to buy them, activation processes, compatibility, and tips for choosing the best…

-

Unleash the Power of Gcash App: The Ultimate Digital Wallet

Unleashing the potential of the Gcash app: Discover seamless mobile transactions, bill payments, online shopping, and peer-to-peer transfers.

-

TM SIM REGISTRATION 2024 | Easy Step-by-Step Guide

The SIM Registration Act stipulates that all SIMs must be registered before being activated. Use this link to register your TM SIM online.

-

Smart SIM Registration 2024 | Easy Step-by-Step Guide

Discover the importance of Smart SIM registration and follow our quick guide to ensure a secure and hassle-free process. Protect your identity now!

-

Unveiling Exceptional Travel Accessories: Your Essential Guide to Enhancing Your Journey

Discover the ultimate travel gear guide: expert reviews and recommendations for luggage, backpacks, and accessories. Enhance your journey with the right gear!

-

Choosing the Right Travel Insurance Company in the Philippines

Find the best travel insurance companies in the Philippines with this comprehensive guide. Compare coverage, benefits, and price to make the right choice for your next trip.

-

THE BEST SIM CARD TO BUY IN THE PHILIPPINES

Find the best SIM card in the Philippines that suits your needs and budget. Reliable coverage, fast data speeds, and affordable pricing.

-

IS YOUR SIM DEACTIVATED? Here’s What You Should Do

Have you missed the deadline for SIM registration? Learn what you can do next to avoid losing access to essential services.

-

What Should You Do If Your PH SIM Card Is Lost Or Stolen

Lost or stolen SIM card? Protect your personal information and get a replacement with our guide on what to do if your Philippines SIM card is lost or stolen.

Explore the Best of Philippines: Must-See Tourist Destinations

The Philippines is a stunning cluster of islands brimming with breathtaking natural wonders and cultural treasures. With over 7,000 islands, the country offers a diverse range of destinations to explore, from bustling urban centers to tranquil shorelines, and historical landmarks to breathtaking terrains. The Philippines caters to every traveler’s needs, whether it’s seeking an adventurous escapade, unwinding on a serene beach, or delving into cultural experiences. This guide presents a curated list of must-see tourist destinations in the Philippines, each of which offers a distinct and charming experience. So, prepare to embark on an adventure to discover the best of the Philippines.

-

April in the Philippines: Weather, Events, Places and More

In April, the Philippines welcomes travelers with its ideal weather, vibrant cultural events, and stunning destinations. Whether you’re seeking beach relaxation, immersive cultural experiences, or outdoor adventures, April offers an…

-

Essential Guide: All You Need To Know About BGC

Bonifacio Global City (BGC) is a rapidly growing financial hub located in Taguig City, Philippines. Considered the fastest growing and most important Central Business District in the country, BGC has…

-

Top Travel Spots in the Philippines in March

If you’re looking for the best places to travel in the Philippines in March, you’re in for a treat. This tropical getaway offers a wide range of stunning destinations and…

-

Top Picks: Best Places to Visit in The Philippines This December

Planning a trip to the Philippines this December? You’re in for a treat! The Philippines is a vibrant and diverse country that offers a plethora of exciting destinations to explore…

-

Find the Perfect Destination in the Philippines This November

November is the perfect time to visit the Philippines, with its pleasant weather and a wide range of exciting destinations to explore. As the start of the dry season, November…

-

Explore the Best Places to Travel in the Philippines this October

October is the month when the Philippines offers the perfect blend of pleasant weather and stunning landscapes. As the rainy season draws to a close, the country becomes an ideal…

-

Explore Siargao: the Surfing Capital of the Philippines

Unleash the adventurer in you and Discover Siargao, the ultimate tropical getaway in paradise. Situated in the Philippines, Siargao is renowned as the Surfing Capital of the country and was…

-

Explore the Stunning Beauty of Honda Bay Palawan

Honda Bay Palawan in the Philippines is a stunning destination that offers a plethora of natural wonders and exciting experiences. This coastal paradise is known for its crystal-clear turquoise waters,…

-

Explore Intramuros: The Heart of Old Manila’s Rich History

Intramuros is the ancient heart of Manila, a walled city that showcases the rich history and Spanish architecture of Old Manila. Built by the Spaniards as their political and military…

-

Unveiling the Beauty of Bolinao Falls in Pangasinan

Discover the stunning Bolinao Falls in Pangasinan – a natural paradise that promises a breathtaking experience. Immerse yourself in the serene ambiance and witness the beauty of nature at its finest.

-

Top Natural Wonders in the Philippines

Discover the captivating natural wonders of the Philippines, from underground rivers to majestic hills. Explore beauty that astounds!

-

Discover Enchanting Locations in the Philippines in July

Discover the best places to visit in the Philippines this July, from vibrant Manila to stunning Boracay and off-the-beaten-path gems. Unforgettable adventures await!

-

Explore the Rich Culture and Natural Wonders of the Philippines

Discover the top 10 must-visit destinations in the Philippines, from Boracay’s white sand beaches to Palawan’s stunning landscapes.

-

Explore Bohol In A Day: Comprehensive Tour of Iconic Attractions

Discover the best of Bohol Island with a full-day tour covering must-see attractions like the Chocolate Hills, Tarsier Sanctuary, and Loboc River Cruise.

-

Unlocking the Wonders of Pinto Art Museum: A Comprehensive Guide to Ticket Prices and More

Discover the ticket prices and tips to save money when visiting Pinto Art Museum. Explore all galleries and exhibits with this helpful guide.