Introduction

In the fast-paced digital era we find ourselves in, the need for seamless, secure, and convenient financial transactions has become more prevalent than ever before. Mobile payment apps have emerged as powerful tools that revolutionize the way we handle our finances, providing a level of convenience and efficiency that traditional payment methods simply cannot match. One such app that has garnered significant attention and acclaim is Gcash.

Gcash app download link: Android | Apple

Brief overview of the Gcash app

Gcash is a mobile payment app that originated in the Philippines and has since become a dominant force in the global fintech landscape. Developed by Globe Telecom Inc., one of the country’s leading telecommunications companies, Gcash was initially introduced as a mobile money service aimed at providing financial services to unbanked individuals. However, it quickly evolved into a comprehensive digital wallet platform with robust features catering to both banked and unbanked users alike.

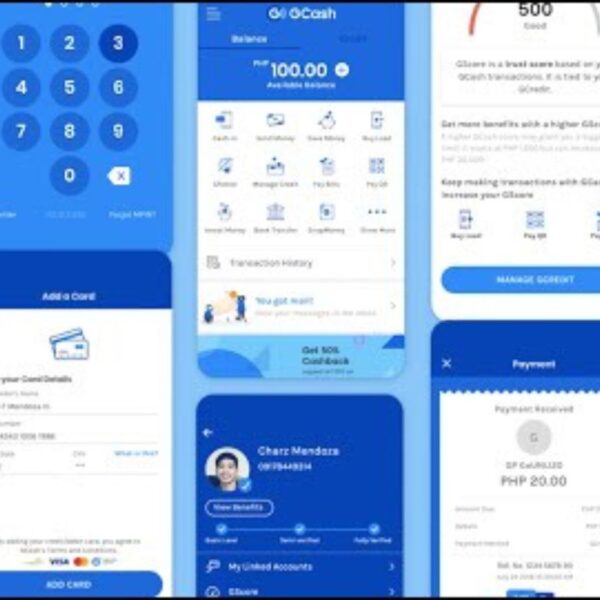

With its user-friendly interface and a wide array of functionalities, Gcash allows users to perform various financial transactions through their smartphones, eliminating the need for physical cash or carrying multiple cards. From transferring money to friends and family members to paying bills or shopping online – Gcash offers an all-in-one solution for managing one’s finances conveniently from anywhere at any time.

Importance of mobile payment apps in today’s digital world

The rise of mobile payment apps like Gcash reflects the growing shift towards a cashless society. Traditional methods such as physical currency or even plastic cards are becoming increasingly outdated when compared to the benefits offered by these innovative digital solutions.

One key advantage of mobile payment apps is their ability to simplify financial transactions. With just a few taps on your smartphone screen, you can securely complete transactions within seconds without fumbling for change or swiping cards at brick-and-mortar stores.

Moreover, mobile payment apps provide a higher level of security. With features such as biometric authentication and encryption protocols, these apps ensure that your financial information remains protected from potential threats.

This added layer of security offers peace of mind to users who may be concerned about the vulnerability associated with traditional payment methods. Furthermore, mobile payment apps contribute to fostering financial inclusivity by providing services to individuals without access to traditional banking systems.

Gcash, for example, enables unbanked individuals to perform essential financial transactions such as receiving remittances or paying bills digitally, eliminating the barriers imposed by physical cash or a lack of bank accounts. The convenience offered by mobile payment apps cannot be overstated.

Users can access their finances at their fingertips anytime and anywhere – whether it’s paying bills on the go or making online purchases without the hassle of manually entering card details repeatedly. Mobile payments streamline everyday transactions and save valuable time for users.

Mobile payment apps like Gcash have become indispensable in today’s digital world. They offer an unprecedented level of convenience, security, and accessibility to users worldwide while contributing significantly to the ongoing revolution toward a cashless society.

Understanding Gcash App

History and development of Gcash

Gcash, a remarkable mobile financial service, originated in the Philippines and has since transformed into a comprehensive platform that revolutionizes the way people handle their money. It was first introduced in 2004 by Globe Telecom, one of the leading telecommunications companies in the country. Initially launched as a mobile money service aimed at providing financial inclusion to unbanked and underbanked populations, Gcash quickly gained popularity due to its convenience, security, and accessibility.

Over time, Gcash evolved from being a basic mobile wallet to becoming an all-encompassing financial platform that offers various financial services beyond just money transfers. Recognizing the increasing demand for digital payment solutions and recognizing the potential to reshape the financial landscape in the Philippines, Gcash expanded its offerings to cater to a broader range of user needs.

Origin as a mobile money service in the Philippines

The inception of Gcash as a mobile money service filled an essential gap in the Philippine market. In a country where only around one-third of adults have access to traditional banking services, Gcash bridged this divide by enabling users to perform basic financial transactions using only their mobile phones. From sending and receiving money to paying bills and purchasing goods online without needing physical cash or bank accounts, Gcash provided Filipinos with an accessible avenue for managing their finances securely.

Through strategic partnerships with local banks and remittance centers, Globe Telecom expanded its reach further by allowing users to “Cash-In” or load funds into their Gcash wallets through various channels such as bank transfers or remittances from abroad. This feature proved invaluable for many Filipinos who relied on overseas remittances as it simplified the process of receiving funds while minimizing risks associated with carrying cash.

Evolution into a comprehensive financial platform

Recognizing its users’ evolving needs and the potential of mobile technology, Gcash transformed from a mobile money service into a comprehensive financial platform. Leveraging technological advancements and customer feedback, Gcash expanded its range of services beyond basic transactions. A standout feature of Gcash is its mobile wallet capabilities, which allow users to store funds securely in their virtual wallets.

This functionality facilitates seamless transactions, enabling users to pay for goods and services at participating merchants without physically handling cash or swiping cards. With just a few taps on their smartphones, Gcash users can enjoy the convenience and security of contactless payments.

Moreover, Gcash offers versatile cash-in and cash-out options that provide easy access to funds. Users can load money into their Gcash wallets through various channels like bank transfers or partner outlets spread across the country.

Conversely, when needing physical cash on hand, Gcash provides options for withdrawing funds through ATMs or partner outlets with minimal hassle. Additionally, Gcash simplifies bill payments by integrating with major utility companies.

Users can settle their utility bills effortlessly through the app while also enjoying features like scheduled payments and reminders to avoid late fees. This service streamlines the payment process for Filipinos by eliminating the need for queuing in payment centers or worrying about overdue bills.

Gcash enables peer-to-peer money transfers with exceptional ease. It allows users to transfer funds instantly to friends or family members using either QR codes or phone numbers linked to their recipients’ accounts.

This convenient feature eliminates traditional barriers associated with sending money such as account numbers or complicated bank details while also providing an option for users to include personalized messages along with the transfer. In essence, through its evolution into a comprehensive financial platform, Gcash has not only simplified day-to-day financial transactions but has also empowered individuals by giving them greater control over their finances in an increasingly digital world.

Mobile Wallet Features

Cash-in options: bank transfers, remittances, etc.

The Gcash app offers users a seamless and hassle-free experience when it comes to cashing in. With integration across various banks in the Philippines, Gcash users can easily transfer funds from their bank accounts directly into their Gcash mobile wallet.

This integration eliminates the need for multiple transaction steps and provides a convenient way to access funds. Additionally, Gcash has established partnerships with remittance services worldwide, allowing international users to conveniently send money to their Gcash wallets from anywhere around the globe.

Cash-out options: ATMs, partner outlets, etc.

When it comes to withdrawing cash from their Gcash wallets, users have an extensive network of partner outlets at their disposal. These partner outlets include convenience stores, supermarkets, and other establishments throughout the Philippines. This wide network ensures that users can easily find a location near them to withdraw cash when needed.

Moreover, Gcash also introduces cardless ATM withdrawals using QR codes. By simply generating a QR code within the app, users can visit any participating ATM and scan the code without needing a physical card.

Bill Payments and Online Shopping

Utility bill payments are made effortless

Gcash simplifies the process of paying utility bills by integrating with major utility companies in the Philippines. Users can easily pay their electricity bills, water bills, internet bills, and more directly through the app’s interface.

Not only does this save time and effort compared to traditional methods of bill payment but it also ensures that payments are made on time by offering scheduled payments and reminders. With Gcash taking care of bill payment reminders on behalf of its users, late fees become a thing of the past.

Seamless online shopping experience

For avid online shoppers in the Philippines, Gcash offers a seamless experience by integrating with popular e-commerce platforms. Users can make purchases on these platforms using their Gcash wallet as a payment option, eliminating the need to enter credit card details or bank information for each transaction. Additionally, Gcash users enjoy exclusive discounts and promotions when shopping on these platforms, making their online shopping experience even more rewarding.

Cashless Payments Made Easy

Gcash revolutionizes the way we make payments by introducing QR code scanning for merchant transactions. By simply scanning a unique QR code generated by partnered stores, restaurants, and establishments accepting Gcash as a payment method, users can effortlessly settle bills without worrying about carrying physical wallets or loose change. Through seamless transactions using QR codes at physical locations, users enjoy enhanced convenience and security.

Gone are the days of fumbling for exact amounts or waiting for change – with Gcash, purchases are completed swiftly and efficiently. The perks of using Gcash extend beyond physical stores: online shopping becomes more convenient with integrated payment gateways.

Users can enjoy a smooth checkout experience while making purchases on various e-commerce platforms that support Gcash as a payment option. By eliminating the hassle of filling out lengthy payment forms, Gcash streamlines the online shopping process, ensuring a seamless and secure transaction.

Peer-to-Peer Transactions

Transfer money instantly to friends or family members

Gcash provides a convenient and efficient way to transfer money instantly to friends or family members. By utilizing QR codes or simply entering the recipient’s phone number, users can initiate peer-to-peer transfers within seconds. This feature eliminates the need for physical cash exchanges and allows individuals to securely send funds wherever they may be.

Option to send personalized messages along with the transfer

In addition to quick and secure money transfers, Gcash allows users to add a personal touch by including personalized messages along with their transactions. Whether it’s a heartfelt message of gratitude or a simple note accompanying the transferred amount, this feature adds warmth and emotional connection to every transaction made through the app.

Remittance Services for Local and International Transfers

Gcash caters to users who need to send money locally or internationally by offering quick and reliable remittance services. Through the app’s intuitive interface, sending money to friends, family members, or business partners is as easy as a few taps on your smartphone screen.

What sets Gcash apart from traditional remittance channels is its affordable fees. By leveraging digital technology rather than relying on physical infrastructure like brick-and-mortar remittance centers or banks with high overhead costs, Gcash provides users with competitive rates without compromising on security or speed.

Conclusion

Discovering the power of the Gcash app opens up endless possibilities for managing finances and conducting transactions in today’s digital world. With its seamless mobile wallet features enabling hassle-free cash-in options from various banks and remittance services worldwide, coupled with an extensive network of partner outlets for easy cash-out options including innovative cardless ATM withdrawals using QR codes—Gcash truly revolutionizes financial convenience.

Moreover, its integration with major utility companies simplifies bill payments while scheduled reminders help avoid late fees. Furthermore, Gcash enhances online shopping experiences through its integration with popular e-commerce platforms and exclusive discounts for users.

And lastly, peer-to-peer transactions become effortless as one can transfer money instantly by utilizing QR codes or phone numbers, with the option to include personalized messages. Embrace Gcash and experience a world where financial transactions are efficient, secure, and rewarding.