Welcome to our comprehensive guide to BPI’s banking hours. Keeping track of branch operating hours is crucial for efficient banking in the Philippines. In this article, we will provide you with the updated banking schedule, ensuring you have the latest information on BPI’s branch hours. Whether you need to visit a branch for your banking needs or simply want to plan your day accordingly, knowing the accurate banking hours is essential.

Our guide will not only cover the standard operating hours of BPI branches but also inform you about any recent advisories that may affect banking operations. We understand the importance of staying informed, and our goal is to provide you with all the necessary details to make your banking experience hassle-free.

With BPI’s widespread presence and comprehensive range of financial products and services, knowing the branch locations, operating hours, and any potential adjustments becomes paramount. Let us take you through everything you need to know about BPI banking hours so that you can plan your visits accordingly and manage your banking affairs seamlessly.

Key Takeaways:

- Being aware of BPI’s updated banking schedule is essential for efficient branch visits.

- Our guide provides comprehensive information on BPI’s branch locations and operating hours across the Philippines.

- We will also highlight any recent advisories that may affect your banking experience.

- BPI’s digital platforms offer convenient alternatives to traditional banking hours.

- Stay informed through BPI’s official channels to ensure you have the most up-to-date information on branch schedules.

Understanding BPI Branch Locations and Schedules

When it comes to banking with BPI in the Philippines, it’s essential to have a good understanding of the branch locations and schedules. Knowing where and when you can visit a BPI branch will help you plan your banking activities efficiently. In this section, we will provide you with detailed information about BPI branch locations and schedules, ensuring you have all the necessary information at your fingertips.

Branch Accessibility Across the Philippines

BPI has an extensive network of branches across the Philippines, making its services easily accessible to customers throughout the country. Whether you are in the bustling city of Metro Manila or provincial areas, you can find a BPI branch near you. The widespread presence of BPI branches ensures that customers can conveniently access banking services without traveling long distances. No matter where you are in the Philippines, BPI is just around the corner to cater to your financial needs.

Unique Schedules for Metro Manila and Provincial Branches

While BPI branches across the country operate with consistency, there are specific considerations when it comes to branch schedules, particularly for Metro Manila and provincial branches. In Metro Manila, BPI branches typically follow standard banking hours, opening from early morning to late afternoon. However, it’s important to note that some branches may have extended hours or offer limited services during certain days of the week.

On the other hand, BPI branches in provincial areas may have variations in their operating hours to accommodate the needs of the local community. The schedules of these branches may be influenced by factors such as local customs, traditions, or demand. Therefore, it is advisable to check the specific timings of the provincial branch you plan to visit to avoid any inconvenience.

Customary BPI Banking Operation Times

Knowing the customary banking operation times of BPI branches is essential for planning your visits and managing your banking needs efficiently. While the opening and closing hours may vary depending on the location of the branch and any special circumstances, there are general timings that you can expect.

On weekdays, BPI branches typically open at 9:00 AM and close at 4:30 PM. Please note that some branches may have variations in their operating hours, so it’s always advisable to check the specific schedule for the branch you plan to visit.

| Days | Opening Time | Closing Time |

|---|---|---|

| Monday – Friday | 9:00 AM | 4:30 PM |

| Saturday | 9:00 AM | 1:00 PM |

| Sunday | Closed | Closed |

On Saturdays, most BPI branches open at 9:00 AM and close earlier at 1:00 PM. It’s important to note that branches are closed on Sundays and public holidays.

While these are the customary operating hours, it’s worth mentioning that BPI is committed to providing exceptional service to its customers. As such, there may be instances where certain branches extend their hours or remain open on special occasions or during peak periods. It’s always wise to check for any specific announcements or advisories regarding changes in operating hours.

Next, we will focus on the branch schedules in North Luzon and explore enhanced customer service hours in select areas.

Navigating to Your Nearest BPI Branch

When it comes to reaching your nearest BPI branch, finding the right location is essential for convenient banking. Luckily, BPI provides various tools to help you locate the branch nearest to you quickly and efficiently.

Integrated Digital Maps for Easy Branch Finding

With BPI’s integrated branch locator tool, you can easily locate the nearest BPI branch based on your current location. The branch locator tool utilizes digital maps to provide real-time information on branch locations, making it effortless to find the branch closest to you. Whether you’re in Metro Manila or in provincial areas, the branch locator tool ensures you can access the nearest BPI branch with minimal effort.

With the comprehensive branch locator tool and updated information on branch relocations, you can navigate to your nearest BPI branch with ease and confidence.

BPI Banking Hours

Knowing the operating hours of BPI branches is essential for planning your banking activities. BPI understands the importance of providing convenient banking services and ensures that its branches have standardized opening and closing times to serve customers effectively.

Here are the standard banking hours of BPI branches:

| Day | Opening Time | Closing Time |

|---|---|---|

| Monday | 9:00 AM | 4:30 PM |

| Tuesday | 9:00 AM | 4:30 PM |

| Wednesday | 9:00 AM | 4:30 PM |

| Thursday | 9:00 AM | 4:30 PM |

| Friday | 9:00 AM | 4:30 PM |

| Saturday | 9:00 AM | 4:30 PM |

| Sunday | Closed | Closed |

Please note that operating hours may vary for different branches. It is advisable to check the specific operating hours of your preferred branch using BPI’s branch locator tool or by contacting the branch directly to ensure you have accurate and up-to-date information.

It’s also important to consider that during holidays and special events, there may be adjustments to the banking schedule. We will discuss this further in the upcoming sections.

In the next section, we will explore the banking services provided by BPI beyond the standard banking hours and how you can take advantage of digital platforms for remote transactions.

Banking During the Holidays and Special Events

Anticipating Adjustments for National Festivities

As the holiday season approaches, it is important to be aware of any adjustments in banking operations during national festivities. BPI understands the significance of these special events and ensures that customers are well-informed about any changes in branch schedules and services. National holidays often lead to modified banking hours, temporary closures, or limited services in certain branches.

To avoid any inconvenience, it is advisable to check the BPI website, and social media platforms, or contact the BPI customer service hotline for announcements regarding branch schedules during holidays and special events. By keeping yourself updated, you can plan your visits to BPI branches accordingly and make the most out of your banking experience.

Planning Ahead: BPI Services During Holiday Breaks

When preparing for holiday breaks, it is essential to plan and utilize BPI’s services to ensure uninterrupted access to banking facilities. While some branches may have modified schedules or closures during these periods, BPI provides alternative ways to manage your finances.

BPI’s online banking platform allows you to perform various transactions such as fund transfers, bill payments, and account management from the comfort of your home or while on the go. You can also take advantage of BPI’s mobile banking app, which offers seamless banking services right at your fingertips.

By utilizing these digital platforms, you can conveniently check your account balances, make payments, and access other essential banking services, even during holiday breaks. This way, you can enjoy your time off without worrying about any disruptions to your financial management.

BPI Services During Holiday Breaks

| Holiday Break Services | Description |

|---|---|

| Online Banking | Access your accounts and perform transactions through BPI’s secure online platform. |

| Mobile Banking App | Manage your finances using BPI’s mobile banking app, available for iOS and Android devices. |

| ATMs and Cash Accept Machines | Withdraw cash, deposit money, and perform other essential banking services at BPI’s network of ATMs and cash accept machines. |

Online and Mobile Banking Alternatives

This section explores the convenience of online and mobile banking alternatives offered by BPI. With these digital platforms, customers can perform remote transactions, ensuring ease and efficiency in managing their finances.

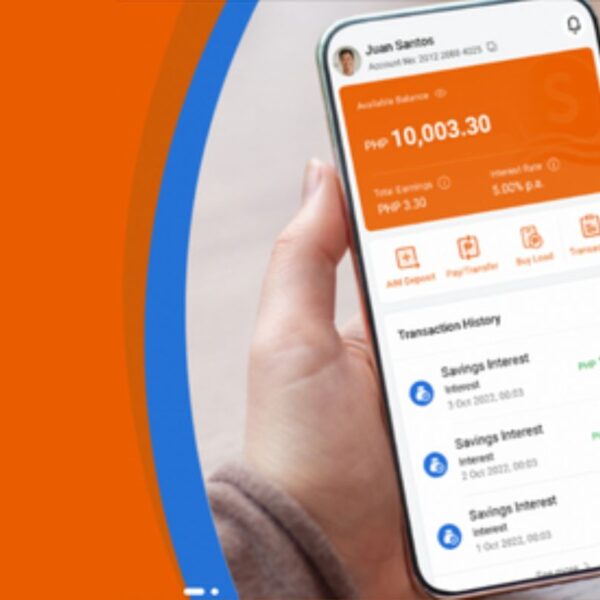

Maximizing BPI’s Digital Platforms for Remote Transactions

Online banking provides numerous benefits, allowing customers to conduct various financial activities from the comfort of their homes or offices. With BPI’s digital platforms, customers can:

- Transfer funds between accounts

- Pay bills online

- Manage account settings and preferences

- View transaction history and account balances

- Set up automatic payments

- Access e-statements securely

Introducing Seamless Banking with BPI’s Mobile App

The BPI mobile app offers a seamless banking experience for customers on the go. With the mobile app, users can enjoy the following features and functionality:

- Secure login with fingerprint or Face ID

- Instant access to account information

- Easy fund transfers to BPI and other bank accounts

- Convenient bill payments to over 600 merchants

- Real-time currency exchange rates

- Location-based branch and ATM finder

- 24/7 customer support

By utilizing BPI’s mobile app, customers can bank anytime, anywhere, without the need to visit a physical branch.

Recent Advisories Affecting BPI Banking Hours

To provide uninterrupted service to customers, BPI regularly communicates important advisories regarding its banking hours. This section will highlight recent advisories that may affect BPI banking hours, ensuring that customers stay informed and plan their visits accordingly.

Impact of Mergers and Upgrades on Operations

As part of its commitment to providing exceptional banking services, BPI occasionally undergoes mergers and upgrades to enhance its operations. These changes can have an impact on branch schedules and banking hours. Customers need to be aware of any adjustments that may arise as a result of these activities. By staying updated on current advisories, customers can plan their visits to BPI branches more effectively and minimize any inconvenience.

Ensuring Uninterrupted Service with Scheduled Maintenance

At BPI, maintaining the efficiency and reliability of its banking services is of utmost importance. To achieve this, scheduled maintenance activities are conducted to ensure that all systems are running smoothly and securely. Although these maintenance activities are carefully planned to minimize disruptions, there may be instances where certain banking services are temporarily unavailable. By being informed about upcoming maintenance activities, customers can adjust their banking transactions accordingly and choose the most convenient time to visit a BPI branch.

Staying informed about recent advisories, mergers, upgrades, and scheduled maintenance is crucial for BPI customers. By regularly checking for updates through BPI’s official channels, such as the website and social media platforms, customers can ensure that they have the most accurate and up-to-date information regarding BPI’s banking hours. This allows for a hassle-free banking experience that aligns with their needs and preferences.

BPI’s Banking Services

In this section, we will take a closer look at BPI’s rich history and the diverse range of financial products we offer. Whether you’re looking to open a savings account, make a fund transfer, or explore our forex services, BPI has you covered.

Brief History of BPI

As the first bank established in Southeast Asia, the Bank of the Philippine Islands (BPI) has a long-standing history dating back to 1851. With over a century of experience, we have built a reputation for trust, reliability, and financial strength. Throughout our journey, we have remained committed to delivering innovative banking solutions that cater to the evolving needs of our clients.

Comprehensive Financial Products

At BPI, we understand that every individual’s financial goals and needs are unique. That’s why we offer an extensive range of financial products to suit various lifestyles and preferences. Whether you’re looking for a savings account to help you achieve your long-term goals or a checking account for convenient day-to-day transactions, we have the perfect solution for you.

Our financial product lineup doesn’t stop there. BPI also offers time deposits for those looking to grow their savings with competitive interest rates, forex services for hassle-free currency exchanges, and convenient fund transfer and bills payment services. Additionally, our remittance services provide a secure and efficient way to send and receive money locally and internationally.

With BPI’s comprehensive suite of financial products, you can confidently navigate your financial journey, knowing that we have the right solutions to support your goals and aspirations.

How to Stay Informed on BPI Branch Schedules

Staying informed about BPI branch schedules is crucial for efficient banking. BPI provides several channels through which customers can access branch schedule updates and announcements. By utilizing these digital channels, customers can conveniently plan their branch visits and avoid any inconvenience.

The primary source for branch schedule updates is the BPI website. The website maintains an updated and comprehensive list of branch operating hours, ensuring accuracy and reliability. Customers can easily access this information by visiting the BPI website and navigating to the branch locator page. By simply entering their location or desired branch, customers can view the current schedule and any relevant announcements.

BPI also leverages social media platforms to communicate branch schedule updates. By following BPI’s official social media accounts, customers can receive real-time updates on any changes to branch operating hours. BPI actively engages with its social media followers, promptly addressing customer queries and concerns regarding branch schedules. This interactive platform allows for direct communication between BPI and its customers, fostering transparency and trust.

In addition to the website and social media, BPI proactively communicates branch schedule updates through its customer communication channels. These channels include email notifications, SMS alerts, and push notifications via the BPI mobile app. By opting in to receive these notifications, customers can stay informed about any changes to branch schedules, ensuring that they are always up to date.

By regularly checking the BPI website, following BPI’s social media accounts, and subscribing to customer communication channels, customers can stay informed on BPI branch schedules. This proactive approach empowers customers to plan their banking activities effectively, saving time and ensuring a seamless banking experience.

Services Beyond Standard BPI Banking Hours

Extended Services for Preferred and Wealth Management Customers

BPI goes above and beyond to provide exceptional banking services to its preferred and wealth management customers. These esteemed clients enjoy a range of exclusive benefits and privileges that extend beyond the standard banking hours.

Preferred customers of BPI have access to personalized services and specialized wealth management solutions. They can benefit from dedicated relationship managers who provide expert advice, tailored financial solutions, and priority assistance in managing their banking needs. Preferred customers also enjoy expedited transactions, preferential rates on deposits and loans, as well as exclusive invitations to wealth management seminars and events.

For wealth management clients, BPI offers comprehensive financial planning services, including investment advisory, estate planning, and trust services. These clients have access to a team of experienced wealth management professionals who provide personalized advice and strategies to help them grow and protect their wealth.

With these extended services, BPI ensures that its preferred and wealth management customers receive the highest level of service and assistance in achieving their financial goals.

Availability of Round-the-Clock BPI Electronic Channels

In addition to the extended services for preferred and wealth management customers, BPI provides round-the-clock access to its electronic channels, allowing all customers to perform banking transactions anytime, anywhere.

The BPI online banking platform and mobile app offer a wide range of services, including fund transfers, bill payments, balance inquiries, and account management. Customers can conveniently access their accounts, make transactions, and monitor their finances with ease. These electronic channels provide a secure and user-friendly interface, ensuring a seamless banking experience.

BPI’s network of ATMs and cash-accept machines also operate 24/7, allowing customers to withdraw cash, deposit money, and perform other transactions at their convenience. The extensive coverage of these machines across the country ensures that customers can access cash and banking services whenever they need them.

By providing round-the-clock electronic channels, BPI empowers its customers with the flexibility and convenience to manage their finances at any time, day or night.

| Extended Services for Preferred and Wealth Management Customers | Round-the-Clock BPI Electronic Channels |

|---|---|

| Personalized services and specialized wealth management solutions | Access to BPI online banking platform and mobile app |

| Expert advice and tailored financial solutions | Convenient fund transfers and bills payment |

| Expedited transactions and preferential rates | Balance inquiries and account management |

| Exclusive invitations to wealth management events | 24/7 availability of ATMs and cash accept machines |

Conclusion

In conclusion, staying informed about BPI’s updated branch schedules is crucial for efficient banking in the Philippines. By knowing the operating hours of BPI branches, customers can plan their visits and avoid unnecessary inconvenience. It is important to note that BPI’s comprehensive financial products, extensive branch network, and commitment to customer satisfaction make it a preferred banking institution in the country.

Furthermore, BPI offers convenient and accessible digital platforms for remote transactions. With online and mobile banking, customers can conveniently manage their accounts, transfer funds, and pay bills anytime, anywhere.

Lastly, it is essential to stay informed about any advisories or announcements that may affect BPI’s banking hours. Customers are encouraged to regularly check the BPI website, follow their social media platforms, and utilize other customer communication channels to stay updated on any changes or maintenance activities that may impact their banking experience. By utilizing these resources, customers can ensure uninterrupted access to BPI’s services and stay ahead of any operational adjustments.

In summary, being aware of BPI’s banking hours, utilizing their digital platforms, and staying informed about advisories are key aspects of efficient and seamless banking with BPI. Whether it’s visiting a branch or accessing banking services remotely, BPI is committed to providing a reliable and convenient banking experience for all its customers in the Philippines.

FAQ

What is the purpose of this article?

The purpose of this article is to provide a comprehensive guide to BPI’s banking hours, including branch locations, schedules, and any recent advisories that may affect banking operations.

What services does BPI provide?

BPI offers a wide range of financial products, including savings accounts, checking accounts, time deposits, forex services, fund transfer, bills payment, and remittance services.

Where are BPI branches located?

BPI branches are accessible across the Philippines, ensuring customer convenience.

What are the standard operating hours of BPI branches?

BPI branches have typical opening and closing hours, which may vary depending on the branch location and any special circumstances.

Are there any changes to the branch schedules in North Luzon?

Yes, this section provides updated information on the operating hours of BPI branches in North Luzon, including any changes or adjustments.

How can I find the nearest BPI branch?

Customers can easily locate the nearest BPI branch by using integrated digital maps, such as BPI’s branch locator tool, based on their current location.

What are the branch schedules for BPI?

This section provides detailed information on the standard operating hours of BPI branches, including opening and closing times and any specific considerations.

How does BPI adjust its operations during holidays and special events?

BPI adjusts its operations during national festivities, and this section provides information on any anticipated changes in branch schedules and services.

What online and mobile banking alternatives does BPI offer?

BPI offers online banking services that enable customers to perform various transactions, such as fund transfers, bill payments, and account management. Additionally, BPI’s mobile app provides features and functionality for seamless banking on-the-go.

Are there any recent advisories that may affect BPI banking hours?

Yes, this section discusses any impact of mergers and upgrades on BPI’s operations, as well as provides information on scheduled maintenance activities.

How can customers stay informed about BPI branch schedules?

Are there any services available beyond the standard banking hours?

Yes, this section discusses extended services specifically tailored for preferred and wealth management customers, as well as round-the-clock electronic channels, such as online banking, ATMs, and cash accept machines.